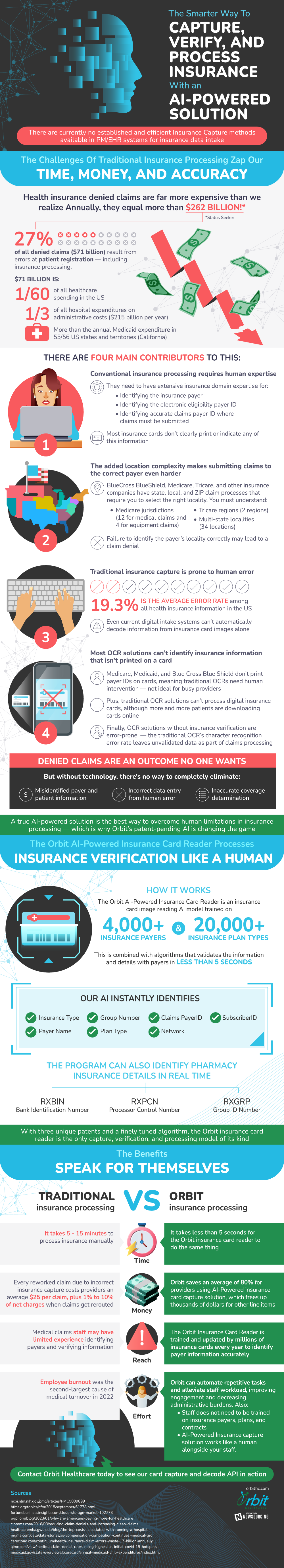

There currently exists no efficient insurance capture methods, leaving the industry in an outdated state. Traditional insurance processing has many issues, stealing time, money, and accuracy from the process. Denied claims due to errors can be costly, totaling to hundreds of billions of dollars annually. It is for these reasons that experts agree there is a dire need for a new strategy.

The main contributors to these problems lie in the many limitations of traditional insurance capture and verification. Most current solutions are unable to identify any insurance information that is not printed on a card. Because of these shortcomings, humans are needed to finish the process. This requires highly trained individuals to pick up where technology left off. When humans intervene, the chance for error greatly increases. In fact, the current error rate in the health insurance industry is over 19%. These errors can lead to denied claims, which cannot be eliminated without total technological takeover.

Luckily, there are new solutions in the works that involve an AI-powered insurance card capture with API that serve as an alternative to the traditional methods. What current methods can process in minutes, artificial intelligence can do in seconds. Not only is speed increased, but accuracy as well, making this solution the best way to advance a vital industry in our society.

Source: OrbitHC